How Much Does a Straight Pipe Cost? Budget Guide & Price Breakdown

Key Takeaway: Straight pipe costs can range from a few dollars per foot for basic PVC or CPVC to $20–$100+ per foot for stainless or specialty alloys.

Straight pipe costs depend on several factors including material, diameter, wall thickness, and finish. Here’s a brief breakdown:

- Basic Materials: PVC or CPVC costs a few dollars per foot.

- Common Metals: Carbon steel or copper typically ranges from mid-single digits to low tens per foot.

- Specialty Alloys: Stainless steel or other specialty alloys often start around $20–$100+ per foot.

Additional costs may arise from fabrication, fittings, testing, and shipping. Pricing can also be influenced by local supply, order volume, and certification requirements.

Straight Pipe Price Ranges (Today)

Prices for straight pipe vary widely today depending on material, diameter, wall thickness, and finish. Market ranges reflect economy and specialty options: PVC and CPVC occupy the low end, mild steel and aluminum sit midrange, while stainless steel, copper, and exotic alloys command premiums.

Small-diameter, thin-walled tubes cost less than large-diameter, thick-walled counterparts. Surface treatments, certifications, and tolerances add to price. Bulk purchases lower per-unit cost; cut-to-length, threading, or precision machining raise it.

Regional supply, commodity metal prices, and lead times influence current quotes, so buyers should expect notable variability across suppliers.

Quick Buying Checklist: Pick the Right Pipe

The buyer should first consider material and durability to ensure the pipe resists corrosion and meets expected service life.

Next, the correct diameter must be selected to match flow requirements and compatible fittings.

Finally, length should be confirmed to minimize joints and installation adjustments.

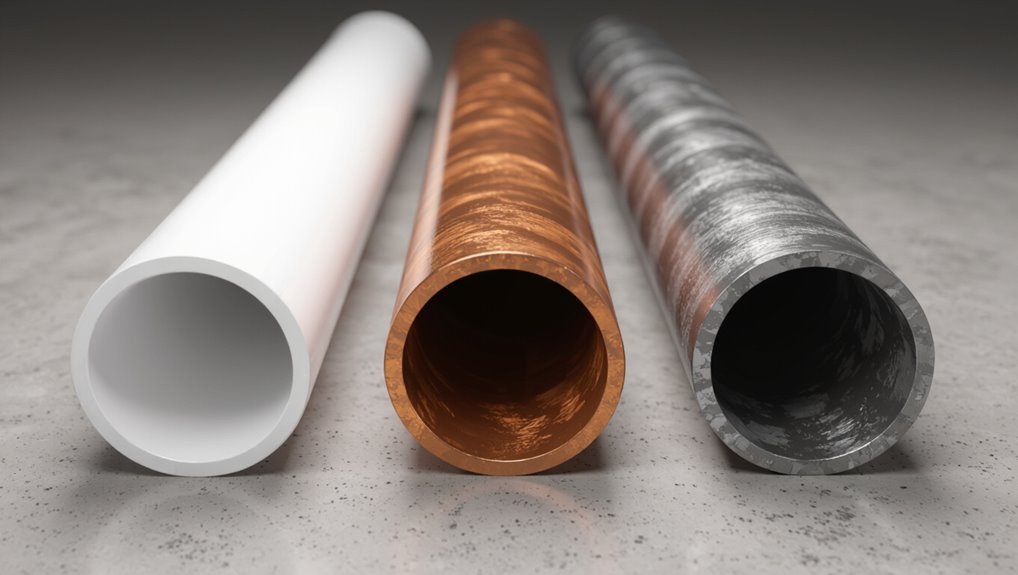

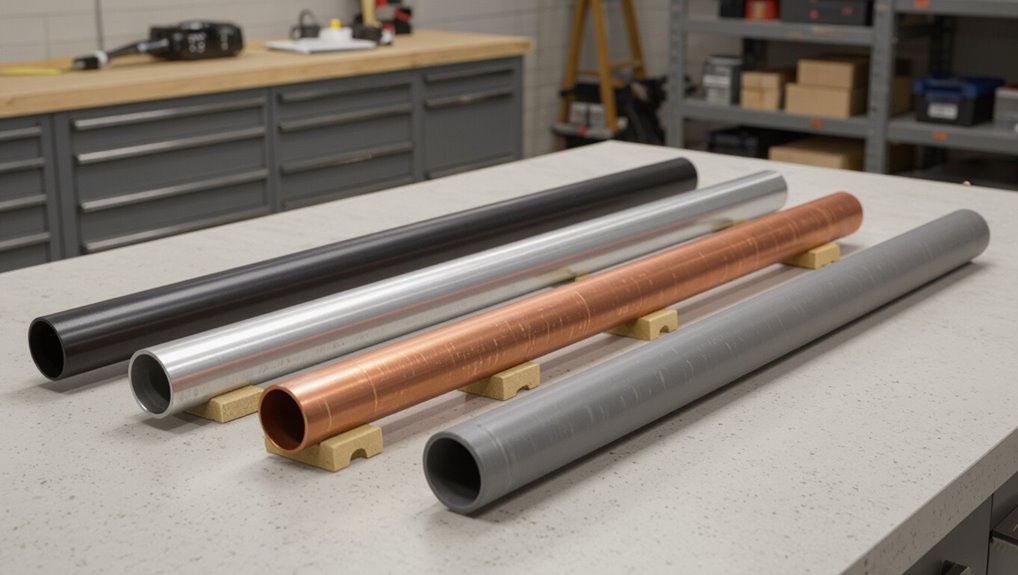

Material And Durability

Considering lifespan and planned use, material choice determines a straight pipe’s durability, resistance to corrosion, and maintenance needs.

Steel offers high strength and heat resistance but may rust without coatings; galvanized steel improves corrosion resistance at added cost.

Stainless steel provides excellent longevity and low upkeep for corrosive environments, raising initial expense.

Copper resists corrosion and is easy to join, suited for plumbing but vulnerable to theft and chemical attack.

PVC and CPVC are lightweight, inexpensive, and corrosion-free for many applications but have lower temperature tolerance and mechanical strength.

Select material balancing environment, expected service life, and budget.

Correct Diameter And Length

Choose diameter and length based on flow requirements, fit, and installation constraints: diameter affects fluid velocity, pressure drop, and compatibility with fittings, while length determines material needed and total friction loss.

The buyer should calculate required flow rate and acceptable pressure drop, then select a diameter that maintains velocity within recommended limits to avoid erosion or sedimentation.

Measure run length including allowances for cuts, joints, and waste.

Account for future expansion, bends, and elevation changes that increase effective length.

Confirm matching connectors, valves, and insulation needs.

Accurate sizing minimizes operating costs, guarantees performance, and prevents costly replacements.

How Material Affects Straight Pipe Cost (Steel, Copper, PVC)

Material choice has a major impact on straight pipe pricing, with steel generally priced for strength, copper commanding a premium for corrosion resistance and thermal performance, and PVC offering lower upfront costs.

Buyers should weigh initial purchase price against installation and longevity when comparing steel versus copper costs.

Considering PVC cost advantages alongside long-term material value helps determine the most economical option for a given application.

Steel Versus Copper Costs

When selecting pipe for a given project, the choice between steel, copper, and PVC directly shapes both upfront cost and long-term expense. Steel generally costs less per foot than copper but adds weight and welding/labor expenses; copper offers corrosion resistance and higher material cost. Project scale, labor rates, and durability expectations determine net value. Typical applications favor steel for structural or high-pressure where cost matters; copper suits potable water or where longevity offsets price. Comparative factors: material unit price, installation complexity, maintenance needs.

| Material | Typical Cost | Key Trade-off |

|---|---|---|

| Steel | Low–Medium | Heavy, welds required |

| Copper | High | Corrosion-resistant |

| PVC | Low | Lightweight, cheaper |

PVC Cost Advantages

Shifting from comparisons with steel and copper, PVC stands out for its low purchase price and reduced installation expenses.

Its lightweight profile lowers handling and transport costs, while simple cutting and solvent-weld joining shorten labor time.

Corrosion resistance eliminates protective coatings and frequent replacements associated with metal pipes, reducing immediate outlays.

Standardized dimensions and wide availability keep material costs predictable and competitive.

For non–high-temperature and non–high-pressure applications, PVC’s chemical resistance minimizes specialized fittings.

Bulk purchasing and common inventory reduce per-unit expense for large projects, making PVC a cost-efficient option when application constraints align with its performance limits.

Long-Term Material Value

Three core factors determine long-term value for straight pipe: durability and maintenance needs, lifecycle cost including replacements and downtime, and residual value or recyclability at end of service.

Steel offers high strength and long service life in structural or high-pressure uses but requires corrosion control, raising maintenance and coating expenses; scrap value offsets some end-of-life cost.

Copper resists corrosion, reduces leak-related downtime, and commands strong resale value, though upfront material cost is higher.

PVC has low initial cost, minimal maintenance, and chemical resistance, but shorter lifespan under UV or heat and negligible recycling value, shifting long-term costs toward earlier replacement.

Alloy & Grade: How They Change Per-Foot Price

Because chemical composition and mechanical properties directly determine material cost and processing difficulty, alloy selection and grade are primary drivers of straight pipe per-foot price. Higher-alloy steels, stainless variants, and specialty metals raise raw-material cost and machining time; lower grades reduce price but limit strength and corrosion resistance. Buyers balance required tolerance, weldability, and lifecycle against budget. Certification and traceability (e.g., ASTM, EN grades) add markup. The market premiums for nickel, chromium, or molybdenum content are notable. Typical examples:

| Alloy type | Typical grade | Cost impact |

|---|---|---|

| Carbon steel | A36 | Low |

| Stainless | 304 | Moderate |

| Stainless | 316 | High |

| Nickel alloy | Inconel | Very high |

Pipe Diameter Pricing: 1/2″ to 4″ and Larger

The guide next compares per-foot pricing across common diameters from 1/2″ up to 4″ and notes how larger sizes shift costs.

It outlines the primary factors that drive those price differences—material volume, manufacturing complexity, and handling or shipping requirements.

This summary prepares the reader to understand cost implications when selecting pipe diameter.

Price By Diameter

Pipe diameter is a primary driver of material and fabrication costs, with prices rising as nominal sizes increase from 1/2″ through 4″ and into larger industrial dimensions.

Pricing typically scales with cross-sectional area and wall thickness: 1/2″ and 3/4″ sizes remain lowest, 1″–2″ represent mid-range, and 3″–4″ jump significantly due to heavier material and handling.

Above 4″, costs accelerate because of thicker gauges, specialty fittings, and freight.

Standard commodity steels cost less per foot than stainless or duplex grades across all diameters. Buyers should compare unit price per linear foot at the required diameter to budget accurately.

Cost Factors Summary

Often, cost differences across diameters reflect predictable changes in material quantity, fabrication complexity, and logistics. The summary isolates key drivers affecting pricing from 1/2″ to 4″ and larger sizes. Material type, wall thickness, and diameter scale unit costs; fabrication needs such as cutting, beveling, and testing raise labor and tooling expenses; transport and handling impose surcharges for oversized or heavy runs; market factors—steel or alloy availability, tariffs, and demand cycles—alter base prices.

Understanding these elements enables accurate budgeting and comparative sourcing across sizes and materials.

- Material grade and wall specification

- Fabrication and finishing requirements

- Transportation, packaging, and handling

- Market supply, tariffs, and order volume

Wall Thickness (Schedule) and Cost Differences

Many factors determine how wall thickness—expressed as pipe schedule—affects straight pipe cost, including material used, manufacturing method, and application pressure requirements.

Thicker walls increase raw material per foot, raising unit price; they also demand more energy and processing time, slightly elevating fabrication costs.

High schedules offer greater pressure ratings and longer service life, which can justify premium pricing for critical systems.

Conversely, lower schedules reduce weight and cost but may limit allowable stress and longevity.

Buyers balance schedule selection against safety factors, code requirements, and lifecycle expense; specifying the minimum acceptable schedule optimizes upfront cost without compromising performance.

Seamless vs. Welded Straight Pipe: Price Comparison

Wall thickness choices influence whether a seamless or welded straight pipe is more economical for a given application, because each manufacturing method interacts differently with material use, yield, and processing costs.

The comparison centers on base material cost, fabrication complexity, inspection needs, and volume-driven pricing.

Seamless pipe typically commands a premium for high-strength, defect-free billets, while ERW/welded pipe reduces raw material waste and is cheaper in long runs.

Corrosion allowance, tolerances, and post-weld treatments shift cost parity.

Buyers weigh upfront price against lifecycle expenses and procurement scale to determine which option minimizes total project cost.

- Material yield and scrap rates

- Fabrication and heat-treatment costs

- Inspection and certification requirements

- Order volume and supplier tooling impacts

Per-Foot vs. Pre-Cut Pipe Pricing

How does buying pipe by the foot compare to purchasing pre-cut lengths for a project? Buying per-foot offers flexibility for custom runs, reducing waste when measurements vary; it often costs less per linear foot but may require cutting tools and labor.

Pre-cut lengths simplify planning and speed installation, useful for repeatable segments, and include handling or cutting fees in the price.

Quantity discounts apply to both options differently: bulk per-foot orders lower unit price, while bulk pre-cut orders reduce fabrication costs.

Selection depends on project complexity, on-site labor capacity, and inventory management, balancing material cost against time and convenience.

Surface Finishes and Coating Costs (Galvanized, Painted, Polished)

The section compares common surface treatments—hot-dip galvanizing, factory-applied paint systems, and mechanical polishing—and their typical cost drivers.

It outlines the galvanizing process, contrasts paint types and application methods, and summarizes polishing grades and labor intensity.

Cost implications for durability, maintenance, and appearance are highlighted to guide selection.

Galvanizing Process Overview

In discussing surface finishes for straight pipe, galvanizing is a common protective method that bonds a zinc coating to steel to resist corrosion and extend service life.

The process typically involves cleaning, fluxing, and immersion in molten zinc (hot-dip galvanizing) or applying zinc electrochemically (galvannealing), producing a metallurgically bonded layer with predictable thickness and longevity.

Costs reflect preparation, batch size, and post-treatment handling; thicker coatings and specialized alloys raise price.

Service conditions determine required specification and expected maintenance intervals.

- Surface preparation: degrease, pickling, flux

- Hot-dip vs. electrogalvanized differences

- Typical coating thickness ranges

- Factors affecting quoted price

Painted Finish Options

For exterior and interior applications where corrosion resistance, aesthetics, or color coding are required, painted finishes provide a versatile and cost-effective alternative to galvanizing.

Options include primer-only, single-coat enamel, and multi-coat systems with epoxy or polyurethane topcoats.

Choice depends on exposure, desired lifespan, and budget: primers are cheapest, epoxies offer strong adhesion and corrosion resistance, polyurethanes add UV stability and gloss retention.

Application methods—spray, brush, or powder coat—affect labor and finish consistency.

Maintenance frequency and repainting costs should be factored into lifecycle pricing.

Color matching and regulatory coatings (e.g., low-VOC) influence unit cost.

Polishing Methods Comparison

Comparing polishing methods clarifies how surface finish, achievable gloss, and preparation costs interact with coating choices like galvanizing and painting. The detached analysis contrasts mechanical buffing, electropolishing, abrasive flow, and chemical polishing by cost per unit, labor intensity, and compatibility with subsequent coatings. Selection hinges on desired corrosion resistance, visual uniformity, and budget for precoat work. Polished surfaces may reduce paint adhesion unless treated; galvanizing requires roughness tolerance. Trade-offs include upfront polishing expense versus reduced maintenance or higher aesthetic value. Specifications should match lifecycle cost projections and coating method constraints.

- Mechanical buffing: low cost, variable finish

- Electropolishing: high cost, superior uniformity

- Abrasive flow: medium cost, complex geometry

- Chemical polishing: moderate cost, environmental controls

Tolerance & Precision: Industrial vs. Plumbing Cost Impact

When held against industrial standards, the tolerance and precision requirements of plumbing-grade straight pipe are markedly different, and those differences drive cost at every stage from material selection to final inspection.

Industrial applications demand tighter dimensional tolerances, specialized alloys, and advanced fabrication methods, increasing scrap rates and machining time. Plumbing-grade pipe tolerances are looser, allowing simpler extrusion or roll-forming and lower inspection frequency.

Certification and traceability requirements for industrial components add administrative overhead and testing costs. Consequently, precision-driven manufacturing, calibration, and rejection management inflate unit price compared with mass-produced plumbing pipe, where economies of scale and relaxed specs lower overall cost.

Retail vs. Wholesale Pricing: When to Buy Which

Should a buyer prioritize immediate convenience or volume savings, the choice between retail and wholesale pricing hinges on purchase size, frequency, and storage capacity. The buyer evaluates unit cost versus flexibility: retail suits small jobs and urgent replacements, wholesale favors contractors or long-term projects with predictable demand.

Payment terms, return policies, and minimum order quantities affect net cost. Seasonal promotions and membership pricing also shift the balance. Decision logic compares carrying costs and cash flow impact against per-unit savings to determine the most economical channel.

- Order volume thresholds and unit price breakpoints

- Storage and inventory carrying costs

- Return and warranty differences

- Cash flow and payment terms

Local and Geographic Price Factors

Local and geographic factors can markedly change straight pipe costs. Urban areas often have higher prices due to greater demand and higher local labor rates, while rural locations may face added transport or availability surcharges.

Regional differences in material supply and contractor pricing further influence final expenses.

Urban Vs. Rural Pricing

Across metropolitan areas and remote counties, geography and population density drive substantial differences in straight pipe costs. Urban projects typically incur higher labor rates, permit fees, and traffic-management expenses, while rural jobs face longer travel times, limited contractor availability, and occasional premium for emergency sourcing. Density affects installation speed and staging; remoteness increases logistical overhead. Buyers should consider demand-driven pricing and scheduling variance when budgeting.

- Urban: higher hourly labor, stricter permitting, faster material turnover

- Rural: travel premiums, fewer contractors, potential scheduling delays

- Both: variable equipment mobilization and site access complexity

- Budget: include contingency for location-specific surcharges

Regional Material Availability

In many regions, the availability and price of straight pipe materials hinge on nearby suppliers, transportation routes, and seasonal demand.

Local stock levels of steel, PVC, or copper influence lead times and bidding dynamics; scarcity elevates wholesale margins and prompts buyers to weigh alternatives.

Proximity to manufacturing centers or ports lowers freight costs, while remote areas face surcharges and limited product variety.

Regional regulations and trade patterns can affect import options and material standards, altering effective prices.

Bulk-buying networks, distributor competition, and periodic market disruptions (weather, harvests, industry cycles) further shape local material costs and choices.

Local Labor Rates

Within a given market, labor rates for installing straight pipe reflect a mix of wage scales, prevailing trade certifications, union presence, and the cost of living. Local labor influences total project cost through hourly rates, minimum crew sizes, overtime norms, and travel premiums; urban centers often command higher charges while rural areas may add mobilization fees.

Contractors adjust bids for permit familiarity and local inspection practices, affecting schedule and contingency estimates. Buyers should request itemized labor breakdowns and region-specific references to compare estimates reliably.

- Union versus non-union wage differentials

- Local license and certification requirements

- Typical crew composition and productivity

- Travel and mobilization surcharges

Labor & Installation: Replacement Cost Ranges

Replacing straight pipe systems typically involves labor costs that vary with pipe material, length, access difficulty, and regional wage rates.

Typical residential replacements range from $200 to $1,200 for straightforward runs using common materials and easy access.

More complex jobs—longer runs, confined spaces, multiple joints, or heavier materials—commonly fall between $1,200 and $3,500.

Commercial or industrial projects with specialized fittings, high elevations, or safety requirements can exceed $5,000.

Estimates should separate labor from materials and disposal.

Hourly rates, job complexity, permit requirements, and technician skill influence totals; obtaining multiple quotes yields the most accurate budget forecast.

Shipping, Handling, and Cutting Fees to Budget

Shipping, handling, and cutting fees can add substantially to the baseline cost of straight pipe and should be considered when budgeting.

Shipping costs vary with distance, carrier, weight, and expedited options, while handling and insurance cover loading, storage, and damage protection.

Additional charges for cutting and fabrication depend on material type, precision required, and labor rates.

Shipping Cost Factors

When planning costs for straight pipe purchases, buyers should account for separate charges beyond the base price: freight, handling, and any cutting or customization fees.

Shipping cost factors vary by carrier, distance, and delivery speed; dimensional weight and palletization influence rates.

Oversize or hazardous materials incur surcharges.

Cutting services may add per-cut or setup fees and affect returnability.

Accurate measurements and consolidated orders reduce expenses.

Clear documentation and scheduling prevent accessorial charges.

- Carrier selection: LTL vs. full truckload impacts unit cost

- Packaging: crates or pallets change dimensional weight

- Transit time: expedited delivery raises rates

- Cut-to-length: per-cut and minimum order fees

Handling And Insurance

Beyond carrier choice and cut-to-length fees, handling and insurance add predictable and occasional costs that should be budgeted separately. The section outlines typical fee types: dock handling, lift-gate service, palletizing, and cargo insurance premiums. Small orders may incur minimum handling charges; oversized or heavy bundles attract surcharges. Insurance is often calculated as a percentage of declared value plus administrative fees; buyers may waive coverage if assuming risk. Clear documentation and packaging reduce claims and unexpected costs. Use the table below to compare common fee triggers, typical ranges, and mitigation strategies.

| Fee type | Typical range | Mitigation |

|---|---|---|

| Dock handling | $10–$75 | Consolidate shipments |

| Lift-gate | $20–$150 | Use curbside pickup |

| Palletizing | $5–$40/pipe | Supplier packaging |

| Cargo insurance | 0.5%–2% value | Self-insure carefully |

Cutting And Fabrication Fees

Although cut-to-length and fabrication services can be quoted per piece or per hour, they should be budgeted separately from base material and freight costs because they add predictable and variable line items such as sawing, beveling, threading, notching, and secondary machining.

Fabrication fees cover setup, machine time, consumables, and inspection; they may include minimum charges and rush premiums. Estimating requires job sheets or samples, as complexity, tolerances, and secondary operations drive cost. Consolidating cuts and batching work reduces per-piece expense. Clear specifications and quotes prevent scope creep and unexpected billing.

- Setup and minimum run charges

- Per-operation pricing (bevel, thread)

- Tolerance and inspection fees

- Rush and secondary machining premiums

Common Add-Ons: Fittings, Flanges, Seals and Their Prices

Frequently overlooked, fittings, flanges, and seals are essential add-ons that determine installation complexity, leak resistance, and total project cost. Pricing varies: basic fittings (elbows, tees) run $0.50–$15 each; flanges range $5–$80 depending on material and rating; seals and gaskets cost $0.10–$25. Labor rises with specialty pieces and tight-tolerance flanges. Project budgeting should include spare seals and commonly used fittings to avoid downtime. Corrosion-resistant or custom machined parts increase lead time and expense. The table below summarizes typical categories and price ranges.

| Item Type | Typical Price Range | Notes |

|---|---|---|

| Fittings | $0.50–$15 | By size/material |

| Flanges | $5–$80 | Pressure rating matters |

| Seals | $0.10–$25 | Spare recommended |

Warranty, Certification, and Testing Costs to Expect

After accounting for fittings, flanges, and seals, project planners should also budget for warranty, certification, and testing expenses that can materially affect total cost and schedule.

Warranty terms vary by supplier and material; extended coverage raises upfront price but reduces long‑term risk.

Certification for pressure ratings, material traceability, or code compliance incurs lab fees and documentation charges.

Testing—hydrostatic, non‑destructive, or dimensional inspections—adds per‑piece or batch costs and potential rework time. Include contingency for failed tests and expedited certifications when schedules compress.

- Supplier warranty extensions and deductible structures

- Third‑party material certifications (mill test reports)

- Hydrostatic and NDT service fees

- Reinspection and expedited processing charges

Where to Save: Affordable Substitutes and Acceptable Uses

When balancing budget and performance, project teams can often substitute lower‑cost materials or fittings in non‑critical runs—such as using galvanized or threaded black steel for short, low‑pressure service, or PVC/CPVC for cold, non‑potable lines—while reserving higher‑grade alloys and seamless pipe for high‑pressure, corrosive, or safety‑critical systems.

Decision makers evaluate service conditions, expected life, and maintenance access to identify acceptable tradeoffs: using welded carbon steel where jointed pipe suffices, choosing standard schedule thicknesses, selecting off‑the‑shelf fittings, and prefabricating assemblies to reduce labor.

Documentation of limits and periodic inspection plans guarantee substitutes perform acceptably without compromising system integrity.

When to Invest More: Corrosion Resistance and Durability

Balancing upfront cost against long‑term performance requires prioritizing corrosion resistance and durability in systems exposed to aggressive media, high temperatures, or limited maintenance access.

Higher‑grade alloys, coatings, or plastic composites reduce failure risk, downtime, and replacement frequency; selecting materials should follow fluid chemistry, temperature cycles, and expected service life.

Lifecycle cost analysis often favors premium options where leaks, contamination, or collapse carry high consequences.

Specification must account for joint integrity, abrasion, and galvanic interactions.

Documentation, standards compliance, and inspection intervals further inform the decision to pay more upfront.

- Evaluate fluid chemistry and pH impact

- Compare expected service life estimates

- Assess maintenance accessibility and frequency

- Consider compatibility with fittings and fasteners

Cost Examples: Home Plumbing, Exhaust, and HVAC Projects

Cost examples for home plumbing, exhaust, and HVAC projects illustrate how straight pipe selection and installation choices affect total spend across common residential jobs.

A typical copper water supply run (20–30 feet) often costs more per foot than PEX; material plus fittings and soldering raises labor.

Bathroom vent stacks use PVC or ABS; short runs remain inexpensive, longer vertical stacks add support and seal costs.

Vehicle exhaust sections vary by diameter and stainless steel choice; muffler-to-tailpipe replacements contrast with custom systems.

HVAC condensate and refrigerant lines require proper material and insulation; longer or higher-gauge runs increase both material and technician time.

How to Estimate Total Project Cost From Per-Foot Prices

Estimate total project cost by converting per-foot pipe prices into a complete bill of materials and labor hours, then adding fixed overheads and contingency.

The estimator compiles lengths, fittings, supports, and waste factors, multiplies by unit prices, and schedules installation hours with hourly rates.

Fixed permits, equipment rental, and disposal fees are added.

A contingency percentage covers unknowns.

Produce line-item subtotals, then sum materials, labor, fixed costs, and contingency for the project total.

Verify quantities on site and revise estimates accordingly.

- Include waste allowance (cutting, mistakes)

- Account for different pipe types and fittings

- Separate site mobilization fees

- Apply locality tax and permit rates

Bulk Buying and Contractor Pricing Tips

After compiling a complete bill of materials and labor hours, the estimator should explore bulk purchasing and contractor pricing strategies to reduce per-foot expenditures and improve bidding accuracy. Volume discounts from suppliers, long-lead ordering and consolidated shipments lower unit costs; compare quotes from multiple distributors and request tiered pricing.

For contractors, evaluate labor crews’ efficiency, minimum mobilization fees, and bundled service discounts. Negotiate warranties, return policies, and change-order terms to avoid unexpected costs. Factor in storage, handling, and financing for bulk stock. Document assumptions and sensitivity to quantity to present defensible bids and identify where economies of scale apply.

Sample Budgets: Low, Mid, and Premium Straight Pipe Builds

Three sample budgets—low, mid, and premium—illustrate how material selection, fabrication methods, and contractor scope drive total straight pipe build costs.

The low budget prioritizes economy: basic steel tubing, minimal fittings, and DIY installation.

The mid tier balances cost and durability with galvanized or thin stainless, professional welding, and modest finishing.

The premium option uses high-grade stainless or specialty alloys, precision bending, polishing, and full contractor warranties.

Each tier includes labor, hardware, inspection, and contingency estimates adjusted for complexity and location.

Decision factors include longevity, corrosion resistance, required tolerances, and expected service life.

- Material grade and availability

- Fabrication technique and quality

- Labor and contractor reputation

- Inspection and warranty provisions

Conclusion

Concrete numbers clarify budgets, yet uncertainty lingers; straight pipe pricing is both precise and pliable. Readers may grasp per-foot rates and material trade-offs, while project surprises—hidden fittings, labor, and site quirks—remind them costs bend. Armed with diameter charts and bulk-buy tips, homeowners can plan confidently but remain ready to adapt. Practical certainty sits beside inevitable variability, turning informed preparation into flexible readiness for any plumbing, exhaust, or HVAC build.